Fixed Income Portfolio and Asset Management

For clients seeking fixed income portfolio management, we offer actively-managed tax-exempt and taxable individual bond portfolios designed to meet your specific investment needs. Managed by our in-house fixed-income team, our bond strategies are designed to achieve income and performance objectives by maintaining a commitment to:

- Investment-grade credit rating

- Intermediate maturity

- High liquidity

- Economic sector diversification

Ready to talk to our wealth management team about the right fixed income portfolio for you? Contact us today.

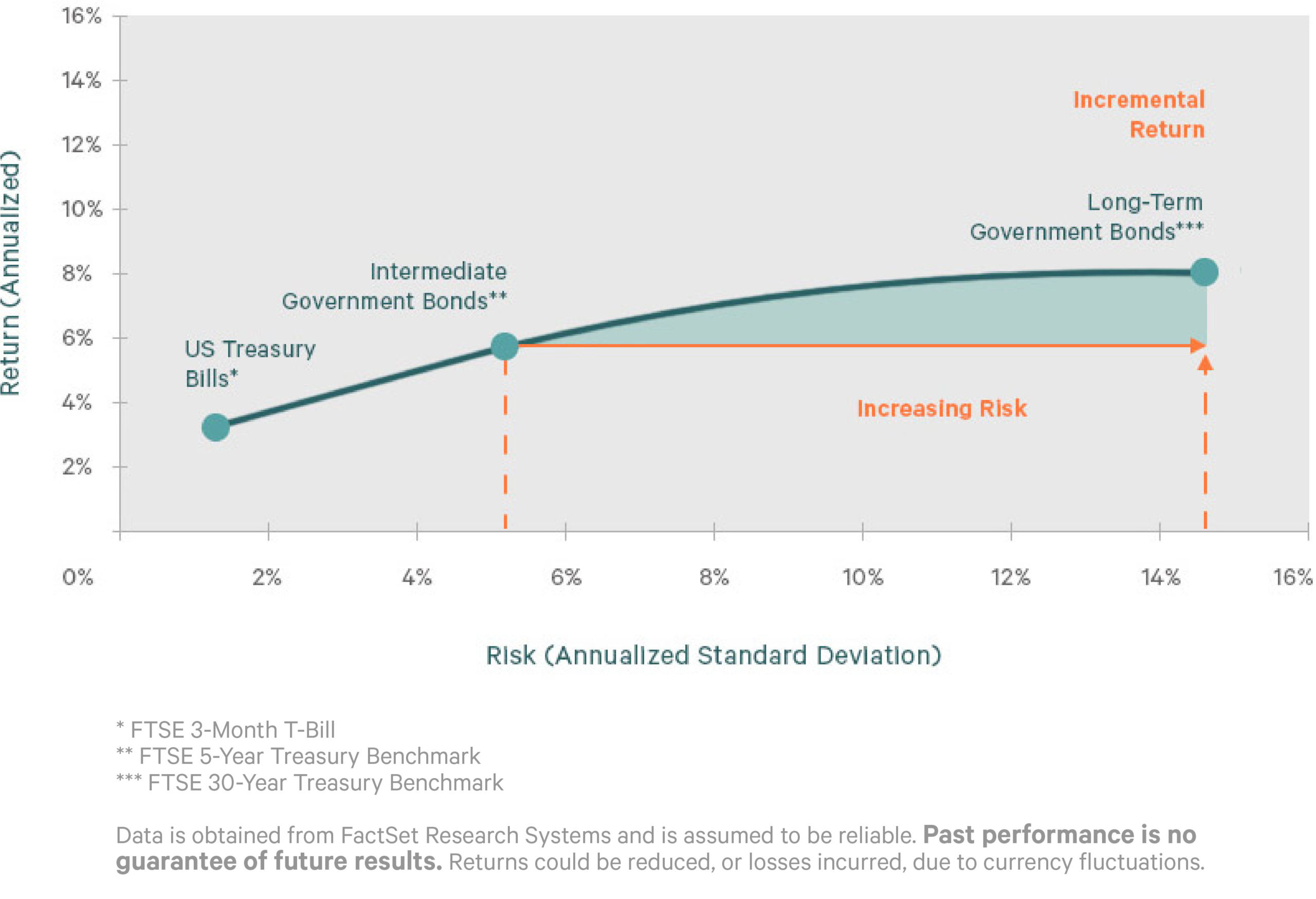

Fixed Income Philosophy

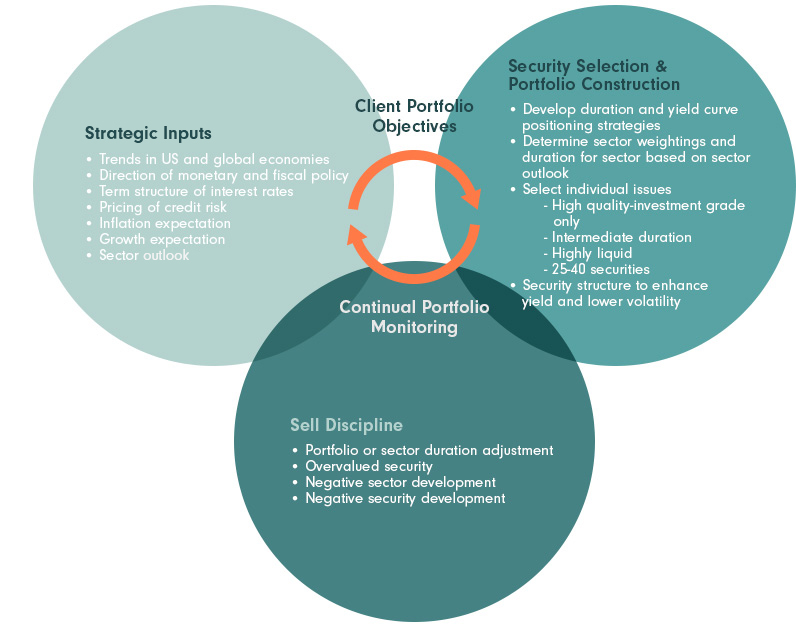

Fixed Income Investment Process

High-quality, intermediate-term portfolios that provide investors with current income exempt from state and federal income taxes, and seeks to preserve principal, produce low volatility, and provide a total return above the market index over a full economic cycle.

Asset Class: Intermediate Municipal

Primary Index: Bloomberg Capital 5-Year Municipal Bond Index

Portfolio Manager: Kimberly C. Friedricks

Download PDF files:

High Quality Intermediate Municipal Bond PortfolioA high-quality, intermediate-term maturity portfolio that preserves principal and seeks to provide a total return above the market index over a full economic cycle.

Asset Class: Total Return Fixed Income

Primary Index: Bloomberg U.S. Intermediate Government/Credit Bond Index

Portfolio Manager: Kimberly C. Friedricks