Charitable deductions have long been known to reduce an individual’s tax liability. But since the passing of the Tax Cuts and Jobs Act (TCJA) in 2017, you may no longer be receiving tax benefits for your charitable contributions. This is because your itemized tax deductions for charitable donations, state and local taxes paid up to $10k, mortgage interest on a home loan up to $750k, and unreimbursed qualified medical expenses exceeding 7.5% of your Adjusted Gross Income (AGI) may no longer exceed the new high standard deduction threshold.

At Kayne Anderson Rudnick (KAR), our advisors will evaluate if frontloading charitable donations may increase your upfront and long-term tax benefits. This strategy, known as “tax-deduction stacking,” is a way to bump your itemized tax deductions over the standard deduction threshold by bunching several years of charitable contributions into a single tax year.

How does the Tax Cuts and Jobs Act (TCJA) affect the tax benefits for my charitable giving?

The TJCA of 2017 doubled the standard deduction amount you may claim when filing your taxes. This is a flat dollar amount that directly reduces your taxable income and varies based on your age and filing status.

Prior to the passing of the TCJA in 2017, the standard deduction was $6,350 for a single taxpayer and $12,700 for a married couple filing jointly. In 2024, the standard education is $14,600 for a single filer and $29,200 for a married couple filing jointly. When filing your taxes, you can reduce your taxable income by the greater of your flat standard deduction, or the sum of your itemized deductions. While a higher standard deduction may provide increased tax benefits for many families, several charitable households are no longer receiving a tax benefit for their giving.

Who should consider stacking their charitable donations?

If the sum of your itemized tax deductions falls just short of the new standard deduction amount, or you’re expecting an unusually high-income tax year from the sale of a business, real estate property, or other successful investment, you may want to evaluate how stacking your charitable donations can increase your tax benefits.

Here’s an example to demonstrate who may benefit from stacking charitable contributions.

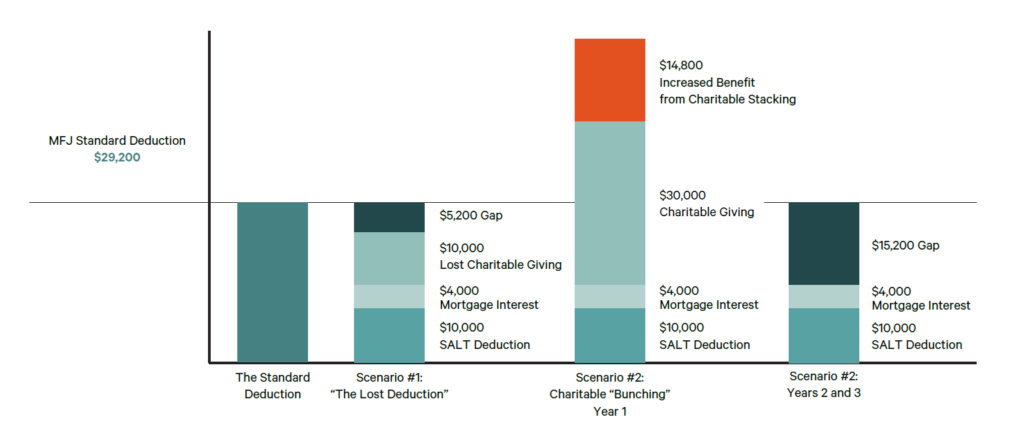

Scenario 1. The Missed Opportunity. The Rogers family would like to donate $10,000 per year to their favorite charity. However, the sum of their itemized deductions is only expected to be $24,000 [$10k to charity + $10k for state/local taxes + $4k mortgage interest paid]. This is just under their standard deduction amount of $29,200 for a married couple filing jointly in 2024. In this case, the Rogers may not receive a tax benefit for their $10,000 charitable donation.

Scenario 2. Stacking Charitable Donations. Here, the Rogers decide to stack three years’ worth of charitable donations in a single tax year, increasing the sum of their itemized deductions to $44,000 [($10k in charitable donations x 3 years) + $10k state/local taxes + $4k mortgage interest paid]. In the two years following their frontloaded charitable donation, they would simply take the high standard deduction instead of itemizing. Over the course of three years, their total tax deductions would equal $102,400 [$44k itemized deduction in year 1, and $29,200 standard deduction in years 2 and 3].

If the Rogers chose not to stack their charitable donations, the sum of their itemized deductions would never exceed their standard deduction. This means over the course of three years their total tax deductions would equate to $87,600 [$29,200 standard deduction x 3 years].

By frontloading three years’ worth of charitable donations in a single tax year, the Rogers family would increase their overall tax deductions by $14,800 [$102,400 – $87,600] over three years.

How can Kayne Anderson Rudnick help with your charitable deductions?

If you’re interested in creating a tax-efficient charitable giving strategy, please contact your KAR wealth advisor. We’ll work together with your tax professional to estimate the potential tax benefits of stacking your charitable contributions.

After reviewing your recent tax returns, current asset allocation, and projected cash flow, we can help you determine how much to give, which investments to donate, and in what years you’ll receive the greatest tax benefit for your charitable gifts.

We can also help you open a Donor Advised Fund (DAF) to facilitate your frontloaded charitable contributions. This is a personal investment account earmarked specifically for charitable giving and can be managed by your KAR advisor, as long as the account has an opening balance of $100,000 or more. The investments in a DAF grow tax-free and can be transferred to your favorite charities at your own discretion.

To discuss how charitable giving may fit into your overall wealth plan, please reach out to your dedicated KAR wealth advisor to schedule your next review.

This information is being provided by Kayne Anderson Rudnick Investment Management, LLC (“KAR”) for illustrative purposes only. Information in this article is not intended by KAR to be interpreted as investment advice, a recommendation or solicitation to purchase securities, or a recommendation of a particular course of action and has not been updated since the date listed on the correspondence, and KAR does not undertake to update the information presented. This information is based on KAR’s opinions at the time of publication of this material and are subject to change based on market activity. There is no guarantee that any forecasts made will come to pass. KAR makes no warranty as to the accuracy or reliability of the information contained herein. The information provided here should not be considered legal or tax advice and all investors should consult their legal and/or tax professional about the specifics of their own legal and tax situation to determine any proper course of action for them. KAR does not provide legal or tax advice and nothing herein should be construed as legal or tax advice, and information presented here may not be true or applicable for all legal and income tax situations. Tax laws can and frequently do change, and KAR does not undertake to update this should any changes occur. Past performance is no guarantee of future results.