When a company goes public through an Initial Public Offering (IPO), it offers investors or employees of the company the opportunity to purchase shares of the company and potentially benefit from its future growth. For employees who have been granted stock options or restricted stock units (RSUs), an IPO can be an exciting time, as it offers the potential for a financial windfall. However, it’s important to approach an IPO with a solid plan seeking to maximize the potential benefits and minimize the risks. In this article, we’ll discuss steps you can take as an investor to prepare for when a company’s stock goes public.

Step 1: Assess Your Financial Goals and Develop a Diversified Investment Plan

Before the IPO, it’s important to evaluate your financial goals and determine how the IPO fits into your overall financial plan. This includes identifying your short-term and long-term financial needs, determining your risk tolerance, and evaluating your current investments.

For example, if you have a high level of debt, it may be beneficial to sell some of your shares post-IPO to pay off the debt. On the other hand, if you have a longterm investment horizon and a high-risk tolerance, you may want to hold on to your shares and potentially benefit from the company’s future growth.

Many employees of companies going public often have behavioral biases that push them to keep an outsized portion of their wealth in company stock. Since they are more familiar with the business and management team, they may feel compelled to keep a very high percentage of their wealth tied to the stock. However, there are certain drawbacks to consider, and diversification is key for an investor in managing risk and maximizing returns over the long-term.

It’s important to avoid overconcentration in a single stock, as this can significantly increase your risk. A concentrated stock holding can be particularly risky for reasons such as heightened volatility, technological disruption, regulatory changes, and potentially significant financial loss if the company underperforms. By spreading your investments across a variety of stocks, bonds, and other assets you may mitigate these risks and reduce the impact of one company on your overall portfolio performance. This means that if one investment performs poorly, it won’t have as significant an impact on your entire portfolio. A well-diversified portfolio may offer greater potential for long-term growth and stability.

Step 2: Evaluate QSBS Qualifications

During the planning phase of the IPO, you may also want to consult with a CPA to check if you qualify for QSBS (Qualified Small Business Stock) tax treatment. Eligible taxpayers may exclude a portion of their capital gains on the sale of certain small business stock from federal income taxes.

To be eligible for QSBS tax treatment, the stock must meet several requirements, including:

- The stock must be issued by a qualified small business (QSB), which is generally a domestic C corporation with gross assets of $50 million or less at the time the stock was issued.

- The taxpayer must have acquired the stock directly from the QSB in exchange for money, property, or services.

- The stock must have been held for at least five years.

If these requirements are met, eligible taxpayers may be able to exclude up to 100% of their capital gains from the sale of QSBS from federal income taxes. The amount of the exclusion depends on the date the stock was acquired, with a higher exclusion percentage available for stock acquired before September 28, 2010.

Step 3: Understand the Tax Implications of an IPO

An IPO can have significant tax implications, so it’s important to understand how the tax code applies to your situation. Depending on the type of stock you have (i.e., stock options, NSOs, RSUs), you may be subject to different tax treatments. A CPA can help you understand the tax implications of a financial windfall.

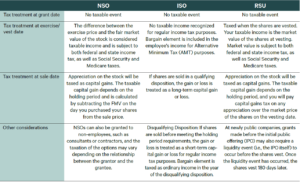

- NSO Tax Treatment: Non-qualified stock options (NSOs) are a type of employee stock option that is not eligible for the favorable tax treatment granted to incentive stock options (ISOs). They are often offered as part of an employee’s compensation package by companies, allowing employees to purchase company stock at a specific price, known as the exercise price or strike price. NSOs can also be granted to non-employees, such as consultants or contractors, and the taxation of the options may vary depending on the relationship between the grantor and the grantee.

- ISO Tax Treatment: Incentive Stock Options (ISOs) are a common type of stock compensation because of their favorable tax treatment. The tax treatment of ISOs can be complex, and the rules vary depending on the individual’s circumstances. Employees who receive ISOs should carefully review the terms of the option grant, consult with a tax professional, and consider the potential tax implications of exercising the options.

- RSU Tax Treatment: RSU stands for Restricted Stock Unit, which is a type of equity compensation where the company grants an employee a certain number of shares of company stock at a predetermined date in the future. The tax treatment of RSUs can be complex and depends on various factors, including the vesting schedule of the shares and the fair market value of the shares at the time of vesting. Generally, RSUs are taxed as ordinary income at the time of vesting, based on the fair market value of the shares on that date. Any subsequent gain or loss on the sale of the shares will be taxed as a capital gain or loss.

In addition to consulting with a tax professional, you can work with a wealth advisor who can help build a comprehensive financial plan for you. A Certified Financial Planner (CFP) can take a holistic look at your financial goals and assets to optimize your wealth.

Step 4: Determine Your Selling Strategy

Once the company goes public, you’ll need to determine your selling strategy. This includes deciding when to sell your shares, how much to sell, and at what price.

One popular strategy is to sell a portion of your shares immediately after the IPO to lock in some gains and reduce risk. With this strategy, investors anticipate future growth of their remaining shares.

Another strategy is to sell a portion of your shares periodically over time. This allows you to take advantage of price fluctuations and potentially maximize tax efficiency. According to a study by Jay Ritter1, a finance professor at the University of Florida, companies that went public between 1980 and 2019 generally underperformed the market by about 2.4% over the first five years after their IPO.

KAR’s wealth advisors have extensive experience guiding clients through pre- and post-IPOs and can help you develop a diversified investment strategy that aligns with your overall financial goals and risk tolerance. Contact our team today to speak with a wealth advisor.

This information is being provided by Kayne Anderson Rudnick Investment Management, LLC (“KAR”) for illustrative purposes only. Information in this article is not intended by KAR to be interpreted as investment advice, a recommendation or solicitation to purchase securities, or a recommendation of a particular course of action and has not been updated since the date listed on the correspondence, and KAR does not undertake to update the information presented. This information is based on KAR’s opinions at the time of publication of this material and are subject to change based on market activity. There is no guarantee that any forecasts made will come to pass. KAR makes no warranty as to the accuracy or reliability of the information contained herein. The information provided here should not be considered legal or tax advice and all investors should consult their legal and/or tax professional about the specifics of their own legal and tax situation to determine any proper course of action for them. KAR does not provide legal or tax advice and nothing herein should be construed as legal or tax advice, and information presented here may not be true or applicable for all legal and income tax situations. Tax laws can and frequently do change, and KAR does not undertake to update this should any changes occur. Past performance is no guarantee of future results.