Navigating how and when to take Social Security and Medicare can be a confusing process. It’s a process we only do once in our lives, but it can have negative financial impacts if done incorrectly. Because of this, it is important to understand your options for these benefits as your 65th birthday (or earlier) approaches.

Some of the most frequently asked questions that we receive from clients include:

- At what age should I take Social Security and Medicare?

- Do I need to take both Social Security and Medicare together?

- Should I wait until “Full Retirement” to take my Social Security benefits?

- What if I will continue to work after 65?

- How many parts of Medicare do I need? Are they all free?

- How is Medicare billed?

Many individuals assume that Medicare and Social Security are packaged together and must be taken together. This is incorrect. They are two different benefits that can be utilized at different times in an individual’s life. Taking Social Security and Medicare should be evaluated separately even though there is some crossover between the two government provided benefits. Let’s start with Medicare:

Medicare Basics

Generally speaking, when an individual is 3 months away from turning 65, they should look to enroll in Medicare. Individuals have a 7-month period starting from 3 months prior to their 65th birthday month (if your birthday is in April, this would be January) to enroll unless they have a “Special Circumstance”.

“Special Circumstances” include continuing to work past 65. If these individuals are covered under an employer sponsored plan available to all employees and the employer has more than 20 employees, they qualify to delay their enrollment in Medicare. Once their employment ends or coverage stops, then they have 8 months to enroll in Medicare. If the individual has chosen to enroll in COBRA, this DOES NOT delay the 8-month period to enroll.1

Parts of Medicare: Below are the most common parts of Medicare.

Please note there are additional supplemental “plans” (not to be confused with “parts”) of Medicare offered through private insurers, e.g: Plan G, Plan F, and Plan K.

- Part A: In most cases, free to the individual. Covers hospitalizations and inpatient Care (including hospice).

- Part B: Covers outpatient care, doctor visits, and preventative services. This part DOES have an associated cost. The standard premium is $170.10, but this may increase depending on an individual’s annual income (IRMAA).

- Part D: Covers prescription drugs. Part D also has an associated cost and plans can be compared at https://www.medicare.gov/plan-compare

What about Part C?

Part C is called Medicare Advantage. This is an alternative, not a supplement, to traditional Medicare. Medicare Advantage is an approved Medicare plan offered by private companies. It is typically a bundle plan that includes the coverage of Parts A, B, and D.2 Medicare Advantage is highly advertised to get individuals to sign up and can provide some advantages such as capping out of pocket costs and providing more benefits for dental and hearing. There can also be disadvantages to using this private company option such as restrictions on the network of providers you use. You should evaluate your personal health circumstance before choosing traditional Medicare or using Part C through a private company.

Penalties and Other Considerations

If you fail to enroll in Medicare in the appropriate time frame (during the 7-month period around your 65th birthday or 8 months after your coverage from your employer ceases) you can be subject to penalties for parts B and D. The penalty is generally a 10% increase in monthly premium for Part A and Part B1. The penalty for Part D is slightly more complicated but is based on how many how months you have been eligible but have not enrolled in Part D1.

Income Related Monthly Adjustment Amount (IRMAA)

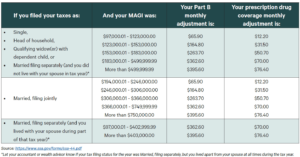

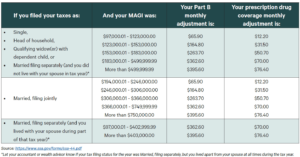

For individuals who have higher income in retirement, their Medicare premiums for Part B and D face a premium adjustment. As an example, potential sources of income in retirement could be portfolio income, income from rental properties, pensions, and annuities.

This adjustment is called IRMAA. IRMAA begins from single filers at $91,000 of their Modified Adjusted Gross Income (“MAGI”) and joint filers at $182,000 of their MAGI. Below is the table from the social security website showing the associated monthly adjustments for Part B and Part D.

The adjustment is based on the prior two years of tax filings which may not reflect a retiree’s income in the future. You can appeal the determination with the social security administration for an adjustment to the increased premium amount. This appeal will need to be substantiated by providing the tax filing for the amount being appealed.3

To enroll in Medicare, you can apply online (https://www.ssa.gov/benefits/forms/#h4), by calling the social security office (1-800-772-1213), or in-person at a local social security office. For more information on Medicare visit https://www. medicare.gov/.

Social Security Basics

Social Security is an income supplement similar to a pension provided to individuals who have accrued credits for eligibility during their working careers. An individual eligible to receive social security benefits can choose when to start these benefits generally between the ages of 62 and 70. Each year an individual waits to take their benefit, the monthly benefit amount increases which makes delaying social security more advantageous. Delaying Social Security allows you increase your monthly benefit for every month you wait to take it. The annual increase is approximately 8%. However, individuals should evaluate the decision of when to take social security based on their holistic financial circumstances.

When is the Best Time to take Social Security?

The best time to take social security is different for everyone. Factors such as current income, lifestyle expenses, health condition, and types of investment accounts can all have an impact on the timing of taking Social Security. Evaluating the sources of income funding an individual’s retirement as well as the taxation of the sources should be a major consideration.

For example, if an individual has assets that can support their living expenses, they then can usually delay taking social security until they reach 70 to maximize their monthly benefit. However, if an individual is using a less tax efficient source of funds (for example, if 100% of funds are from a retirement account and being taxed at ordinary income tax rates), it may be better to take social security earlier since a maximum 85% of social security is taxable.

The benefit of delaying, as stated earlier, is that your benefit increases monthly until you reach the age of 70. Additionally, you do not have increased taxable income because you’re not receiving the benefit yet. Married couples with two social security benefits need to consider the timing of receiving their benefits, whether they both wait, take one, or take both. Taking both benefits at the same time could bump a couple into unanticipated higher tax brackets.

Once you decide when you want to begin your benefits, you can apply to receive them on the social security website https://www.ssa.gov/. You will receive your first Social Security check the month following the month you begin your benefits. It is advisable to speak with your Financial Advisor or CPA to understand the best timing of when to take Social Security benefits.

Premium Payments and Tax Reporting

If you are enrolled in Medicare and receiving Social Security benefits, your Medicare premiums will be automatically deducted from your social security benefit. If you are not currently receiving social security benefits, you will be billed for the Medicare premiums quarterly and you can pay online or via mail.4

Once you begin taking Social Security you will receive a document called the 1099-SSA annual. This document will report your total taxable social security benefits and should be provided to your CPA or tax preparer to report the income you received from Social Security as well as any Medicare premiums paid for Part B and Part D.

Navigating Social Security and Medicare benefits can be confusing and should be considered with an individual’s or family’s holistic financial needs in mind. Financial strategies and plans may need to be adjusted depending on the decision to take or delay your social security benefits. You have earned these benefits over the course of your working career, and you should look to maximize the benefits you receive while avoiding mistakes that can cause costly penalties. Our wealth advisors are available to help you answer any questions you may have about Medicare premiums and Social Security benefits.

Ready to Establish a Partnership You Can Trust?

At Kayne Anderson Rudnick, our proactive wealth advising model means we are prepared to take advantage of new opportunities as they arise. And as circumstances in your life change, we’re ready with a strategy that adjusts to your changing needs. Contact us today to find the expert personal service your financial picture deserves.

1https://www.medicare.gov/

2https://www.medicare.gov/sign-upchange-plans/types-of-medicare-health-plans/medicare-advantage-plans/how-do-medicare-advantage-plans-work

3https://www.medicareinteractive.org/get-answers/medicare-denials-and-appeals/premium-appeals/appealing-a-higher-part-b-or-part-d-premium-irmaa

4https://www.aarp.org/retirement/social-security/questions-answers/medicare-premiums-deducted-ss.html