While much attention has been given to the Magnificent 7 – the seven large cap stocks that have been driving much of the recent growth in the U.S. stock market – we believe there are compelling investment opportunities in U.S. small cap stocks. While investment in much larger companies appears, on the surface, to have such a clear path to gains, we believe small caps can be important drivers of outperformance over a market cycle. Here are four compelling reasons we believe small caps should be getting more attention from investors.

1. Small Caps Should Be a Part of Every Balanced Portfolio

Historically, small cap stocks have generated higher returns than their larger peers over extended periods. That’s because smaller businesses are earlier in their maturation and have more room to grow than larger companies. That being said, we do not believe all small cap stocks are created equal. Because the small cap universe is both large and very diverse in quality, we believe active management is critical to investment outperformance as well as risk management.

2. The Key to Investing in Small Caps Is Being Selective

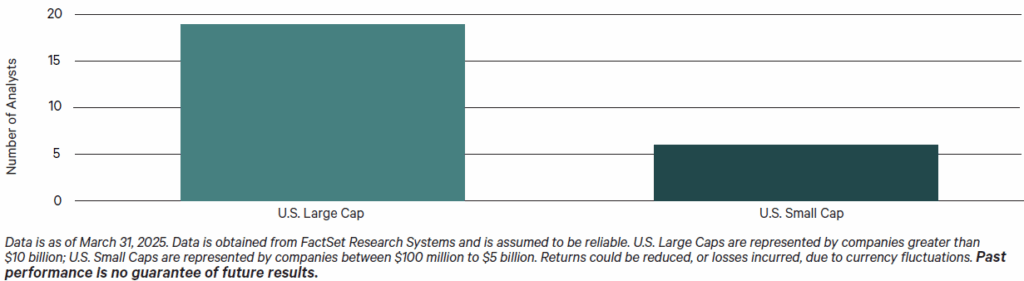

In our view, it’s important to be selective when investing in small cap stocks. Unlike well-known large cap companies, small caps are often businesses the average investor knows nothing about, and they may receive very little Wall Street analyst coverage (Figure 1). As such, they are often overlooked for the larger companies. Because KAR focuses on identifying the qualitative aspects of companies (e.g., durability of a company’s sustainable competitive advantage and management quality), we believe we can seek out small caps that have the potential to endure through multiple business cycles.

FIGURE 1: ANALYST COVERAGE

3. Small Cap Valuations Are Particularly Attractive Right Now

From our perspective, small cap stocks are attractively priced relative to their larger peers as well as their own historical averages. The Russell 2000 Index of small cap stocks is trading at about 15.4 times forward earnings, well below its 10-year average of 16.5 times. Even more significantly, the valuation spread between the Russell 2000 and the large cap-focused Russell 1000 Index is the widest it’s been since the tech bubble burst in the early 2000s. As inflation softens and interest rates decrease, we believe the earnings of high-quality small cap companies will grow at a faster pace than their more well-established large cap peers, creating a significant opportunity for investors in the small cap space.

4. Small Caps Tend to Outperform Large Caps in a Declining Interest Rate Environment

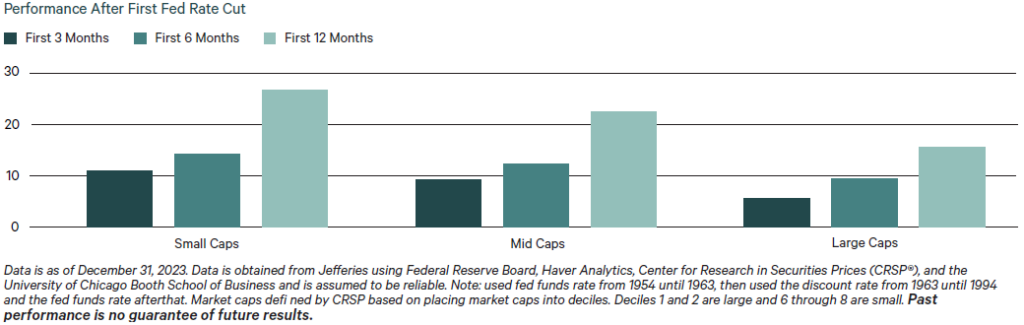

FIGURE 2: RATE CUTS HAVE TENDED TO GIVE THE BIGGEST BOOST TO SMALL CAPS

History has shown that as interest rates decline, small cap stocks tend to outperform large caps (Figure 2). That’s because lower borrowing costs are more meaningful for smaller companies than larger ones. Secondly, lower financing costs make it easier for large companies or private equity to acquire these smaller businesses and earn adequate returns. While past performance does not guarantee future results, small cap stocks have tended to perform well relative to large and mid-cap stocks following the first interest rate cut.

We believe small caps should be a part of every portfolio and, in our view, the current valuations of small caps creates a compelling opportunity to make them part of a balanced portfolio without paying the usual premium to do so. Learn more about why small caps make for a compelling investment, and contact Kayne Anderson Rudnick today to explore our small cap strategy offerings.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 1000® Index measures the performance of the large-cap segment of the US equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the US market. The Russell 1000® Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are included. The indices are calculated on a total return basis with dividends reinvested. The indices are unmanaged, their returns do not reflect any fees, expenses, or sales charges, and they are not available for direct investment.

This report is based on the assumptions and analysis made and believed to be reasonable by Kayne Anderson Rudnick (“KAR”). However, no assurance can be given that KAR’s opinions or expectations will be correct. This report is intended for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. Past performance is no guarantee of future results.