Municipal bonds are issued by government entities or “municipalities” such as states, cities, and counties or special purpose districts such as power, water, schools, and transit to fund public service projects. Some examples of civic government projects and services include first responders, public education, delivery of clean water and treatment of sewage, building and maintaining roads, as well as bridges and airports, to name a few.

Municipal bonds are debt securities issued by municipal entities to bondholders (investors), who essentially are the lenders for the projects. To entice investors to purchase a bond and lend money, municipalities issuing the bond offer to pay interest on the bond. As a benefit to the investor, the interest paid is typically exempt from federal income taxes and often exempt from state and local taxes. Municipal bonds are generally tax-exempt to encourage investors to invest in public use projects that create positive benefits and services for the good of the people.

How to Compare Tax-Equivalent Yields

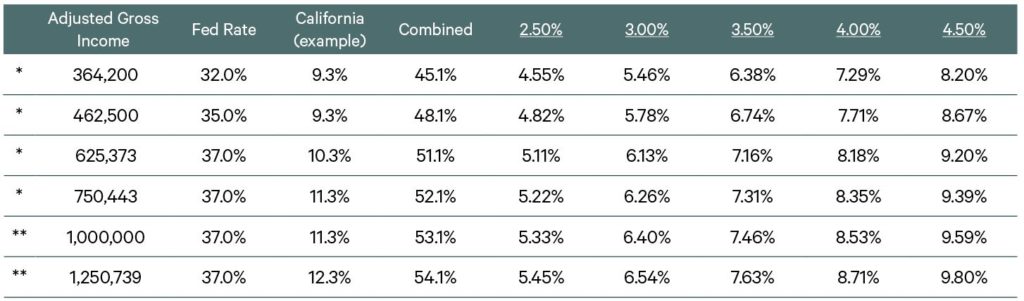

Corporations and for profit entities issue taxable bonds while municipalities primarily issue tax-exempt bonds. Tax-exempt and taxable bonds are often compared by using what is called the tax-equivalent yield, which is the return that a taxable bond requires to equal the yield on a comparable tax-exempt municipal bond after paying taxes. Exhibit 1 shows the current taxable yields required to compete with municipal tax-exempt yields.

Exhibit 1. Comparisons Are Not Always What They Seem

Based on 2023 Federal Married Filing Jointly tax rates and 2022 California Married Filing Jointly tax rates, a couple earning more than $625,000 in California would need to invest in a taxable security that yields over 5.78% to net more than a California municipal bond yielding 3.00%.

Every Bond Has Two Distinct Sides:

Types of Municipal Bonds and Credit Fundamentals

There are two types of municipal bonds: General Obligation (GO) bonds and Revenue bonds.

General Obligation bonds generally guarantee the repayment of the bond based on the creditworthiness of the issuer and its ability to use taxation to raise revenue to pay back issued bonds. Revenue bonds are issued to fund infrastructure projects and are supported by the revenue generated from the project. However, the issuer may not always meet the revenue demands needed to pay back the bond (loan). For instance, a revenue bond issued to build a toll road is funded by the tolls and the tolls could be continually raised to meet any bond revenue shortfalls, but there is no guarantee that the tolls will be enough to repay the bonds used to fund the toll road project. So, creditworthiness, or the ability to pay back the bond, becomes an important selection criterion when purchasing municipal bonds for investment.

Another creditworthiness consideration is the importance of the service or project the bond is fulfilling. At KAR, we tend to focus on essential services and critical infrastructure bonds for our municipal fixed income portfolios. These types of bonds tend to pass what we call the “disaster test,” which means we identify bonds for services and projects that are priorities and considered essential and would be the first services rebuilt after an earthquake or other natural disaster. Services such as water, power, schools, and roadways come to mind as immediate priorities versus damage to a municipal golf course, which would be a low priority.

It is important to recognize even during difficult financial times an essential service bond can increase pricing. For instance, in a high inflation environment and a possible recession on the horizon, we all still continue to pay our electric bills—even when the cost of energy goes up because it is an essential service required for our wellbeing. This makes many essential service municipal credits especially resilient to economic volatility and market disruption. On the other hand, bonds secured by hotel occupancy taxes can fare poorly in a pandemic when people stop traveling.

Diversification also comes into play with creditworthiness. Think of a GO bond that is issued by a large economically diverse county versus a small city that relies on a single employer for the economic health of the community. Another example would be utility districts. It is important to know how many customers the utility has to evaluate the durability of recurring revenues. While default rates in the municipal market are less common than other fixed income markets, they do happen and it is important to understand the sources of revenue that an issuer has to pay back the bonds to bondholders.

All this underscores that discerning a bond’s credit and ability to repay is much deeper and more complicated than looking at a rating. Ratings and the data that informs when credits move up or down in creditworthiness changes over time. In the examples above, is that small city growing? Are new employers building in the town? Are housing tracks being built? On the other hand, is that large county seeing a population decline, are factories and businesses leaving? Was a new city council elected that wants to take finances in a different direction? Has the school district seen a significant population decline? While bonds are frequently held for long periods, the credit decision an investor makes on day one needs to be continually reviewed and assessed whether you hold the bond until maturity or not.

Munis Benefit from Active Management

When it comes to municipal bond investing, we believe there is an advantage to active versus passive (indexing) management. As discussed in this article, there are many considerations to analyze before purchasing a municipal bond. This is not an asset class where you can easily identify creditworthiness, mispricing, and other inefficiencies without significant resources and expertise. Owning municipal bonds blindly may not make sense for most investors. Active managers are more likely to understand and seek out the tax advantages municipal bonds offer since they tend to better understand the nuances of the market and the pitfalls of the complex structures and unique tax treatment of each issuer. For investors in high tax brackets and high-tax states, owning municipal bonds can be a robust wealth preservation strategy and may be worth discussing with your investment advisor. Municipals can lighten tax-burdens, add diversification, help reduce overall portfolio risk, and of course grow assets with annual tax exempt portfolio income.

For additional information and guidance on investing in municipal bonds or bond funds, consult with a Kayne Anderson Rudnick Wealth Management advisor today.

* Includes the 3.8% Net Investment Income Tax.

** Includes above plus 1% Mental Health Services Tax.

Sources: Franchise Tax Board (https://www.ftb.ca.gov/forms/2022/2022-540-booklet.html#2022-California-Tax-Rate-Schedules), Kiplinger: (https://www.kiplinger.com/state-by-state-guide-taxes/california) and eFile (https://www.efile.com/california-tax-forms-rates-and-brackets/#income-bracket). Data is assumed to be reliable. For the 2022 tax year (taxes filed in 2023), California has nine income tax rates, ranging from 1% to 12.3%. A 1% mental health services tax applies to income exceeding $1 million. This information is being provided by Kayne Anderson Rudnick Investment Management, LLC (“KAR”) for illustrative purposes only. Past performance is no guarantee of future results. Returns could be reduced, or losses incurred, due to currency fluctuations.

This information is being provided by Kayne Anderson Rudnick Investment Management, LLC (“KAR”) for illustrative purposes only. Information in this document is not intended by KAR to be interpreted as investment advice, a recommendation or solicitation to purchase securities, or a recommendation of a particular course of action and has not been updated since the date listed on the report, and KAR does not undertake to update the information presented. This article provides links to other websites or resources. KAR has no control over such sites and resources, is not responsible for their availability, and does not endorse and is not responsible or liable for any content, advertising, products, or other materials on or available from them. KAR shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of such sites or resources. Your use of such sites or resources shall be subject to the terms and conditions set forth by them. KAR does not provide tax advice and nothing herein should be construed as tax advice, and information presented here may not be true or applicable for all income tax situations. All investors should consult their tax professional about the specifics of their own tax situation to determine any proper course of action for them. Tax laws can and frequently do change, and KAR does not undertake to update any information presented herein should any changes occur.