President Trump’s recent imposition and subsequent partial rollback of universal tariffs have injected significant uncertainty into the financial landscape. In this article we break down the immediate market reaction to this unprecedented “tariff tidal wave” and explore the rationale behind governmental tariff implementation. We also analyze several potential scenarios for how these broad-based tariffs could impact the stock market and offers insights into developing a resilient investment strategy in the face of such uncertainty.

What Happened? A Tariff Tidal Wave

On April 2, 2025, the Trump administration declared a universal tariff, impacting even goods the U.S. cannot domestically produce. The formula for calculating these tariffs involves the U.S. trade deficit with a country and the value of imports from that nation. The immediate market reaction was stark: Over the following two days, the Dow Jones Industrial Average plummeted by 9.22%, the S&P 500 by 10.51%, and the NASDAQ by 11.43%.

On April 9, 2025, following the initial market shock, the Trump administration moved to mitigate the economic fallout. A 90-day pause was implemented on the increased tariff rates for most nations, signaling a partial retreat from the blanket policy. However, this reprieve did not extend to China. Instead, tariffs on Chinese imports were significantly escalated. This more-nuanced approach triggered a sharp market rebound, reflecting the delicate balance between trade policy and investor confidence. Despite the rally, the underlying 10% blanket tariff on most imports and the increased Chinese tariffs continue to cast a shadow of uncertainty over future market stability.

Why Do Governments Implement Tariffs?

Governments typically implement tariffs for various reasons, including protecting domestic industries, encouraging local production, generating revenue, reducing reliance on foreign suppliers, and responding to other countries’ trade practices. While the U.S. has historically maintained lower average tariffs than some trading partners, the scale and universality of these new tariffs have caught many by surprise.

How Will Tariffs Affect the Stock Market? Some Possible Scenarios

The long-term consequences of these universal tariffs are still unfolding, but several potential scenarios are emerging:

- Inflation and Stagflation: If tariffs persist, consumers will likely face higher prices for imported goods and domestically produced items with increased input costs. While the initial price surge might not lead to continuously rising inflation, the overall price level could remain permanently elevated. Coupled with a potentially stagnant economy due to reduced investment and consumption, this could lead to stagflation.

- Retaliation: Affected countries may retaliate by imposing their own tariffs on U.S. goods, potentially sparking a damaging trade war where both sides suffer. President Trump’s warning of further tariff hikes in response to retaliation only exacerbates this risk.

- Possible Recession: Unlike the more targeted tariffs of the previous Trump administration, these broad tariffs pose a significantly greater risk to economic growth, leading many economists to increase their recession probability forecasts.

- Negotiation: While possible, the uncertainty created by the initial tariffs may persist even with negotiations, as trading partners could be wary of future policy shifts.

- Recalibration: Businesses will likely seek ways to mitigate higher input costs through cost-cutting measures or by accepting lower profit margins, as consumers may resist further price increases.

- U.S. Isolation: Facing higher U.S. tariffs, other nations might forge new trade agreements amongst themselves, potentially isolating the U.S. in the global marketplace.

Navigating Tariffs and Market Volatility with a Long-Term Strategy

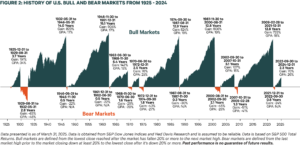

While the current market volatility is undoubtedly unsettling, history reminds us that markets are resilient and have overcome significant challenges. In times like these, we believe a long-term investment strategy is crucial for weathering potential downturns.

Key Recommendations for Investors

- Stay the Course: Resist the urge to make impulsive decisions based on short-term market fluctuations. Historically, trying to time the market often leads to missing out on crucial recovery periods.

- Diversify: A well-diversified portfolio across different asset classes, including bonds and international markets, can help cushion the impact of market volatility in specific sectors. Our advisors can help you construct and maintain a well-diversified portfolio tailored to your risk tolerance and goals.

- Be Selective: Focus on investing in strong, high-quality companies identified through thorough fundamental research. These companies are more likely to weather economic headwinds and lead any potential market recovery. KAR advisors can offer insights and help identify quality investments aligned with your strategy.

- Utilize Financial Planning Tools: Explore opportunities within your broader financial plan, such as Roth IRA conversions, tax-loss harvesting, and estate planning strategies, which can be particularly beneficial during volatile periods.

By focusing on a long-term strategy and maintaining a disciplined approach, we believe investors can navigate these “tariff tremors” and position themselves for future opportunities.

Connect with KAR to explore investment strategies for navigating these challenging times.

Index Definitions: The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The Dow Jones Industrial Average (DJIA) is maintained by S&P Global and is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. The Dow can be used to provide an indicator of the general health of the U.S. economy as well as the way in which the economy is changing. The Nasdaq Composite Index is a market capitalization-weighted index of all common stocks listed on the Nasdaq Stock Market. The index is calculated on a total return basis. The indexes are unmanaged, their returns do not reflect any fees, expenses, or sales charges, and they are not available for direct investment.

Important Disclosures:

This information is being provided by Kayne Anderson Rudnick Investment Management, LLC (“KAR”) for illustrative purposes only. Information in this article is not intended by KAR to be interpreted as investment advice, a recommendation or solicitation to purchase securities, or a recommendation of a particular course of action and has not been updated since the date listed on the correspondence, and KAR does not undertake to update the information presented. This information is based on KAR’s opinions at the time of publication of this material and are subject to change based on market activity. There is no guarantee that any forecasts made will come to pass. KAR makes no warranty as to the accuracy or reliability of the information contained herein. Past performance is no guarantee of future results