In light of recent developments surrounding tariffs and trade policies, we would like to share some insights on the current state of the capital markets and how we are approaching these dynamics from an investment perspective.

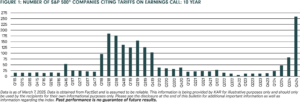

The global economy is navigating a complex period, shaped by inflationary pressures, changing geopolitical tensions, and shifting trade policies. A key area of focus has been the impact of tariffs, which, as we’ve seen historically, can create volatility in markets and influence supply chains. According to FactSet, the term “tariff” was mentioned by 259 companies within the S&P 500 during their Q4 earnings call. This marks the highest number of S&P 500 companies citing tariffs during quarterly earnings calls in the past 10 years. While it’s impossible to predict the exact effect tariffs will have on every company, we believe it’s important to understand how these changes could impact market performance in both the short and long term.

FIGURE 1: NUMBER OF S&P 500® COMPANIES CITING TARIFFS ON EARNINGS CALL: 10 YEAR

In recent weeks, there have been numerous headlines and announcements regarding trade policy. To summarize, the trade conflict escalated after 25% tariffs were applied to Canada and Mexico, and tariffs on China increased by 10% to 20%. However, the 25% tariffs on Canada and Mexico were revised, and all goods covered by the North American trade agreement (USMCA) from these countries will be exempt from tariffs until April 2. Approximately 38% of Canadian imports and 50% of Mexican imports are covered by the agreement, meaning roughly two-thirds of imports from Canada and half of imports from Mexico will now face tariffs. Additionally, the U.S. has been the target of retaliatory tariffs imposed by Canada, Mexico, and China.

One way to think about tariffs is as a one-time price shock. The critical question for companies is whether they can pass these added costs onto customers. This is where pricing power—one of the key competitive advantages we prioritize—becomes essential. Companies with strong pricing power are typically more resilient through periods of volatility, including trade disruptions. While we remain confident that most of the companies we invest in are well-positioned to navigate any potential volatility arising from tariffs, we do acknowledge that the broader economic environment—especially following a period of significant inflation—could affect consumers’ willingness to absorb further price increases.

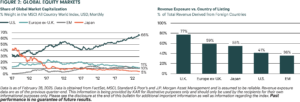

From an economic perspective, we believe that the U.S. is more insulated than other countries and is better positioned to withstand global supply chain disruptions. Approximately 41% of total revenue for U.S. companies is derived from foreign markets, whereas U.K. and European companies derive 77% and 59% of their revenue from international sources, respectively. Over the past few years, we’ve focused our investment efforts on U.S.-based companies, as we hold the view that the U.S. is in the strongest position from an investment perspective, as broad-based U.S. indices have outperformed international markets. In fact, the U.S. share of global market capitalization has steadily increased in recent years to approximately 66%. While we remain optimistic about U.S. companies, we are also mindful that non-U.S. markets are becoming increasingly attractive from a valuation perspective, and we continue to reevaluate our strategy in this regard.

FIGURE 2: Global Equity Markets

At KAR, we remain committed to providing proactive guidance during this period of market volatility. We continue to monitor these developments closely and believe that our investment approach can help position your portfolio to withstand potential challenges while also maintaining a long-term perspective.

As always, please feel free to reach out if you have any questions or would like to discuss how these market shifts may impact your investment strategy.

This information is being provided by KAR for illustrative purposes only and should only be used by the recipients for their own informational purposes. Information

in this bulletin is not intended by KAR to be interpreted as investment advice, a recommendation or solicitation to purchase securities, or a recommendation of a particular course of action and has not been updated since the date listed on the bulletin, and KAR does not undertake to update the information presented. KAR makes no warranty as to the accuracy or reliability of the information contained herein. To the extent performance is presented, past performance is not indicative of future results.

Index Definitions: The S&P 500 Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. The MSCI AC World Index (net) is a free float adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

IMPORTANT RISK CONSIDERATIONS: Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer specific events. Focus on a particular style or on small, medium, or large-sized companies may enhance that risk. Limited Number of Investments: Because certain portfolios have a limited number of securities, they may be more susceptible to factors adversely affecting their securities than a portfolio with a greater number of securities. Market Volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Local, regional, or global events such as war or military conflict, terrorism, pandemic, or recession could impact the portfolio, including hampering the ability of the portfolio’s manager(s) to invest its assets as intended.