Deciding when to claim Social Security benefits is easily one of the more complicated questions of retirement planning. While every American citizen is eligible to claim Social Security benefits at age 62, waiting leads to a greater lifetime benefit for most people. But how do you know whether delaying your benefits or taking them early is right for you? Here are some tips for establishing your own Social Security strategy.

Full Retirement Age (FRA)

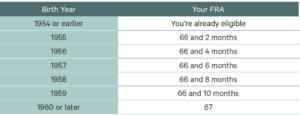

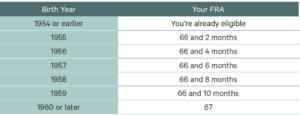

To decide when to start taking your benefits, you first need to understand your full retirement age for Social Security, and that will depend on your birth year. If you were born in 1960, your Social Security retirement age is 67. If you were born in 1955 through 1959, your full retirement age for Social Security (“FRA”) will be between 66 and 2 months and 66 and 10 months. If you were born before 1955, you’ve already reached your FRA.

Calculating Your Personal FRA

Here’s a simple table to help you determine your Social Security benefits age:

Claiming Benefits Early vs. Delaying

You can claim Social Security benefits as early as age 62, before you reach full retirement age, but it’s important to understand that doing so will make your payouts permanently smaller. For example, if your FRA is 66, and you take benefits at age 62, your benefit will be reduced by 25%. If your FRA is 67 and you start your benefits at 62, you’ll see a 30% reduction in benefits. On the surface, it looks like a bad idea to take benefits before your FRA, but there are some reasons why claiming benefits early could make sense. Thus, it’s important to carefully consider how to maximize your Social Security payouts.

Cash Needs vs. Financial Resources

You may want to take Social Security benefits early if you’re short on cash and having trouble making ends meet. If you’ve retired early and have secure income from an investment portfolio or pension, for example, it may make sense to wait until you reach full Social Security retirement age before claiming your benefit.

Predicting Your Life Expectancy and the Delayed Retirement Credit

If you have health issues, can’t work, and/or do not expect to reach average life expectancy (currently age 77 in the U.S.), then it probably makes sense to claim Social Security early. Doing so will certainly reduce your benefits, but you’ll also receive those monthly payments longer.

Of course, if you’re in good health and in solid financial standing, then delaying could maximize your Social Security benefit because your monthly check will be larger. If, for instance, you retire sometime between your FRA and age 70, you will likely earn a delayed retirement credit (DRC). The DRC will increase your monthly benefit by 8% for every year you wait to claim your benefits beyond full retirement age. So, if your FRA is 66, and you don’t take your benefit till age 68, you’ll see a 16% increase in your monthly benefit for the rest of your life.

Spousal Benefits and Your Partner’s Role

Your marital status can also play a role in deciding when to claim your Social Security benefits. Once you reach your FRA, you can take 100% of your own benefit or 50% of your spouse’s. If your spouse is a high-income earner, it may pay off to wait until your spouse reaches their FRA so you can claim his or her higher benefit. That higher benefit will continue in the event your spouse dies before you do.

Employment’s Influence on Benefits

If you plan to continue working beyond age 62 or decide to go back to work after retiring, this can also have an impact on your Social Security strategy. Income from a job or self-employment will reduce your benefit temporarily by $1 for every $2 you earn (up to an annual limit of $21,240) if you take Social Security early. Once you reach full retirement age for Social Security, you can earn as much as you want without reducing your benefit.

The Complex World of Social Security Taxation

Another reason for delaying your benefit, particularly, if you’re working, is taxation. Up to 85% of your Social Security benefits are subject to taxation if your adjusted gross income, non-taxable interest payments, and half of your Social Security benefit hit a certain threshold: $25,000 annually for an individual and $32,000 for a married couple. While it’s best to seek the advice of your tax professional and financial planner, you may want to postpone claiming your benefit until you reach your FRA or until your income is less than the annual limit.

The Bottom Line

Trying to decide whether to take early retirement benefits from Social Security? It’s best to talk with an experienced financial planner and tax professional who can help you evaluate how your income, investments, expenses, taxes, and health considerations may impact your benefits.

Delaying for a Bigger Payout

If you have assets that can cover your living expenses, waiting until age 70 to claim your Social Security benefits may help you maximize that monthly payout. But if you are using taxable funds from a retirement account to pay your bills, then taking Social Security earlier could save you some money since only 85% of Social Security income is taxable.

If you’re married, you’ll have additional considerations on the timing of Social Security benefits. You’ll want to determine whether both you and your spouse should start claiming Social Security benefits and potentially risk bumping yourselves into a higher income tax bracket.

Social Security as Your Retirement Insurance

Waiting at least until your Social Security benefits age will generally pay off in the long run, particularly if you’re in good health, but don’t wait past age 70. A longer-than-expected retirement, inflation, and fluctuating markets represent the biggest risks to claiming Social Security early. If these risks align with your concerns, delaying Social Security may be your optimal strategy for establishing an insurance policy for the future.

Think of Social Security as your retirement insurance — a safety net in the event you live a long time through an era of rising costs and market volatility.

The Importance of Individual Financial Planning

One size does not fit all, however. Your Social Security strategy should be as unique as your retirement dreams. Let us help guide you to maximize your benefits. Contact us at KAR wealth management today.